In the dynamic landscape of insurance and investments, crafting a strategy that ensures financial security and growth is paramount. Unit Linked Insurance Plans (ULIPs) emerge as a compelling solution, offering a distinctive fusion of insurance and investment features. This article aims to delve deeper into the meaning of ULIPs and explore the intricate balance required to navigate risk and returns, providing comprehensive insights that empower individuals to make informed and strategic financial decisions.

ULIP Meaning

Understanding the ulip meaning is crucial for those considering this financial instrument:

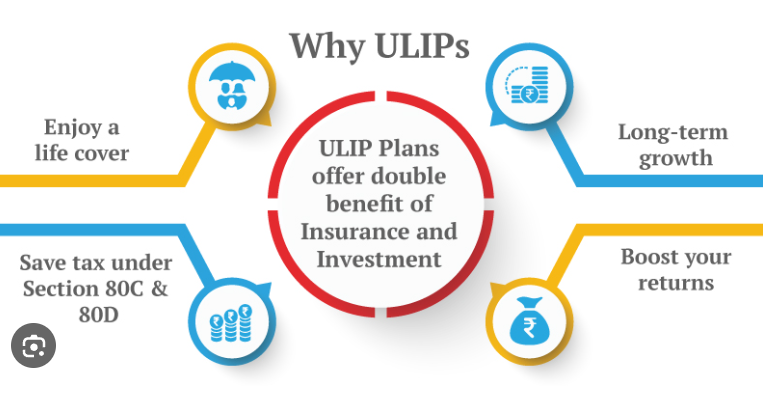

- Unit Linked Insurance Plan (ULIP): ULIPs are financial products that seamlessly integrate life insurance coverage with investment opportunities. A portion of the premium paid by the policyholder goes towards life coverage, while the remaining amount is invested in a diversified fund, offering the potential for wealth creation over time.

- Dual Benefit: The inherent advantage of ULIPs lies in their dual benefit structure. Policyholders can enjoy both insurance protection and the opportunity for wealth accumulation. The choice of funds within ULIPs provides flexibility, allowing individuals to align their investments with their risk tolerance and financial goals.

Balancing Risk and Returns

Achieving an optimal balance between risk and returns is a nuanced task, especially within the context of ULIP investments. Consider these key aspects:

- Risk Tolerance Assessment: Before selecting a ULIP, individuals should evaluate their risk tolerance. Conservative investors may lean towards debt funds, offering lower risk and more stable returns, while those with a higher risk appetite might opt for equity funds, which come with higher potential returns but increased market volatility.

- Diversification Strategies: Diversifying the ULIP portfolio across various asset classes is a prudent risk mitigation strategy. A well-diversified portfolio can shield the investment from the full impact of market fluctuations, providing a more stable overall performance.

- Fund Switching Flexibility: ULIPs offer a unique advantage through fund-switching options. Policyholders can adapt to changing market conditions or personal financial goals by reallocating funds between debt and equity funds. Regular assessment and adjustments ensure that the investment strategy remains aligned with evolving circumstances.

ULIP Calculator

The ULIP calculator serves as a powerful tool in optimizing ULIP investments:

- Purpose and Utility: The primary purpose of the ULIP calculator is to provide policyholders with an estimate of potential returns based on various parameters such as premium amounts, policy terms, and chosen funds. This empowers individuals to make informed decisions that align with their unique financial objectives.

- Customisation Features: ULIP calculators offer a high degree of customisation. By inputting specific details, users can receive personalized projections of the maturity amount and death benefit. This tool facilitates scenario analysis, enabling individuals to explore different premium amounts and policy terms to find the optimal balance between risk and returns.

Tax Benefits of ULIPs

Understanding the tax benefits associated with ULIPs enhances their appeal as a financial instrument:

- Section 80C Deductions: Premiums paid towards ULIPs qualify for deductions under Section 80C of the Income Tax Act. This presents an opportunity for policyholders to enjoy tax savings while simultaneously securing their financial future.

- Tax-Free Maturity Proceeds: The maturity amount and death benefit received from ULIPs are exempt from tax under Section 10(10D). This tax-efficient nature makes ULIPs an attractive investment avenue, especially for those seeking long-term wealth accumulation.

Long-Term Wealth Creation with ULIPs

Leveraging ULIPs for long-term wealth creation requires a strategic approach:

- Goal-Based Investing: One of the strengths of ULIPs is their adaptability to specific financial goals. Whether it’s funding a child’s education, purchasing a house, or building a retirement corpus, policyholders can tailor their ULIP strategy to meet these objectives.

- Compounding Benefits: The power of compounding is a key driver of wealth creation within ULIPs. By staying invested over an extended period, policyholders can benefit from the compounding effect, allowing their investments to grow exponentially over time.

Market Timing and ULIPs

The concern of market timing is a common one among investors, and it is particularly relevant in the context of ULIPs:

- Systematic Investment Approach: ULIPs follow a systematic investment approach, where premiums are invested at regular intervals regardless of market conditions. This strategy, known as rupee-cost averaging, helps to average out the impact of market volatility over time.

- Disciplined Investing: Attempting to time the market can be a challenging and often counterproductive endeavour. ULIP investors are encouraged to adopt a disciplined approach, focusing on regular and consistent premium payments rather than trying to predict short-term market movements.

Conclusion

In conclusion, Unit Linked Insurance Plans represent a comprehensive financial tool that marries insurance protection with investment opportunities. Balancing risk and returns within the context of ULIPs requires a thoughtful and strategic approach, considering factors such as risk tolerance, diversification, and fund-switching flexibility.

The ULIP calculator emerges as a valuable ally in this journey, empowering policyholders to make informed decisions based on their unique financial circumstances.

Furthermore, understanding the tax benefits associated with ULIPs, coupled with a focus on long-term wealth creation through goal-based investing and the compounding benefits of staying invested, solidifies the appeal of ULIPs as a robust financial instrument.